As the financial backbone of a business, bookkeeping is a vital aspect of successful operations. Fill out your training details below so extension of time to file your tax return we have a better idea of what your training requirements are. Our Business Skills Blogs cover a range of topics related to Bookkeeping, offering valuable resources, best practices, and industry insights. Whether you are a beginner or looking to advance your Project Management skills, The Knowledge Academy’s diverse courses and informative blogs have you covered.

Financial Literacy and Accounting Principles

It’s simple to work with, yet it doesn’t compromise on essential functions and features. In 2023, the average bookkeeper in the United States earned an annual salary of $43,748. However, depending on a bookkeeper’s location, niche, and clients, they may command a higher salary, sometimes reaching $50,000 per year or above.

In the modern digital era, bookkeepers execute most tasks using accounting software and spreadsheets. These tools automate many processes, minimize errors, and provide more detailed financial analysis. Investing in education and training is a fundamental step in enhancing your Bookkeeping Skills. Register for relevant courses, workshops, or online programs that cover advanced topics in accounting, tax regulations, and the latest advancements in bookkeeping technology.

Whereas for more relevant information on classes at Potomac Workforce Training & Development Center, visit potomac.theknowledgebase.org. Bookkeeping and Accounting are some of the most essential functions of any business organization. They both require a sharp eye that keeps track of relevant data, yet they do have their differences. Learners are advised to conduct additional research to ensure that courses and other credentials pursued meet their personal, professional, and financial goals.

Learn more about bookkeeping, how it differs from accounting, the required qualifications, and bookkeeping jobs and salaries. Although you certainly can do formal bookkeeping training (e.g., online bookkeeping courses, relevant degree), many bookkeepers simply learn the ropes through on-the-job training. Bookkeeping is the process of keeping track of a business’s financial transactions. These services include recording what money comes into and flows out of a business, such as payments from customers and payments made to vendors. While bookkeepers used to keep track of this information in physical books, much of the process is now done on digital software.

One way to think about it is that bookkeepers lay the groundwork for accountants to analyze and prepare financial statements. A master’s degree in accounting, for example, may help you pursue leadership positions in your field or organization. A graduate degree can also help prepare you for the certified public accountant (CPA) credential from the American Institute of Certified Public Accountants (AICPA). According to AICPA, CPAs earn 10%-15% more than the average starting salary for accountants.

How to test bookkeepers’ accounts payable and accounts receivable skills

This practice helps maintain a sharp eye for details and ensures that your skills remain fresh and up-to-date. Read this blog to learn about the essential Bookkeeping Skills and pave the way for efficient management of financial records. Bookkeepers handle the daily financial records, while accountants analyze these records and provide financial advice. As of the latest data, the Bureau of Labor Statistics reports that the median annual salary for bookkeeping, accounting, and auditing professionals is $45,860. A proper financial data management system can provide valuable, actionable insights and prevent problems, such do dividends go on the balance sheet as skimming fraud. As a bookkeeper, you oversee the first steps of the accounting cycle, while an accountant typically handles the last two.

Data-entry skills

Having the ability to prepare an accurate financial picture of an enterprise and keep records organized is essential for being a bookkeeper. As a bookkeeper, you will need to learn how to create balance sheets, invoices, cash flow statements, understanding your cp3219a notice income statements, accounts receivable reports, and more. Although software and calculators do most of the math, basic skills such as addition, subtraction, multiplication, and division are essential to helping you catch errors quickly. Bookkeeping offers a good starting place in the accounting field, with minimal education and experience requirements.

- Empowering precision in financial management through expert software use, meticulous record-keeping, and robust fiscal analysis.

- While bookkeepers can sit for the CB exam sections in any order, AIPB recommends taking part one before scheduling part two.

- Tailoring learning experiences further, professionals can maximise value with customisable Course Bundles of TKA.

- He helps clients grow their online businesses and occasionally writes blogs to share his experience with other professionals.

How to assess bookkeeping skills and traits

The demand for skilled bookkeepers remains strong, particularly in small and medium-sized enterprises that may not require a full-time accountant. A bookkeeper provides a critical role in the data collection and data input of a business’ accounting cycle. When there is a proper system in place that avoids problems such as skimming fraud, the recorded financial data can provide valuable, actionable insight. A Bookkeeper is responsible for recording and maintaining a business’ financial transactions, such as purchases, expenses, sales revenue, invoices, and payments.

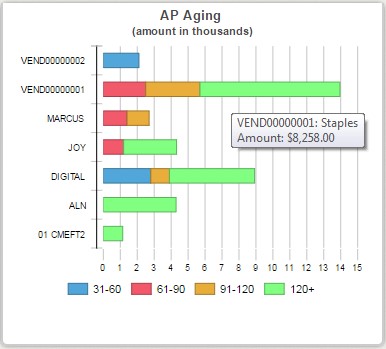

Likewise, the Accounts Payable test asks them to solve specific calculations pertaining to accounts payable. In bookkeeping, problem-solving can pinpoint inefficiencies and mistakes and anticipate potential issues. When anomalies or issues occur, bookkeepers can identify them and determine the reasons behind them using relevant information and asking the right questions. Bookkeepers often need critical-thinking skills to help interpret the story behind the numbers. One of our training experts will be in touch shortly to go overy your training requirements.